Some Known Details About Independent Financial Advisor Canada

Some Known Details About Independent Financial Advisor Canada

Blog Article

Tax Planning Canada Things To Know Before You Get This

Table of ContentsExamine This Report about Independent Financial Advisor CanadaThe Best Guide To Lighthouse Wealth ManagementLittle Known Questions About Independent Financial Advisor Canada.Examine This Report on Financial Advisor Victoria BcSee This Report about Private Wealth Management CanadaLittle Known Facts About Private Wealth Management Canada.

“If you were to get something, say a tv or a personal computer, might would like to know the specs of itwhat tend to be its components and what it can perform,” Purda explains. “You can consider getting economic advice and assistance in the same manner. Folks must know what they're buying.” With monetary advice, it is crucial that you just remember that , the item isn’t ties, shares or any other assets.It’s things like cost management, planning for pension or paying down financial obligation. And like purchasing a computer from a dependable organization, consumers would like to know they truly are purchasing economic advice from a reliable specialist. Among Purda and Ashworth’s most interesting results is around the costs that monetary planners demand their clients.

This presented real irrespective the fee structurehourly, payment, assets under control or flat fee (from inside the learn, the buck worth of fees ended up being the exact same in each situation). “It still comes down to the worthiness proposal and anxiety about consumers’ part that they don’t know very well what they're getting back in trade of these charges,” claims Purda.

Not known Details About Private Wealth Management Canada

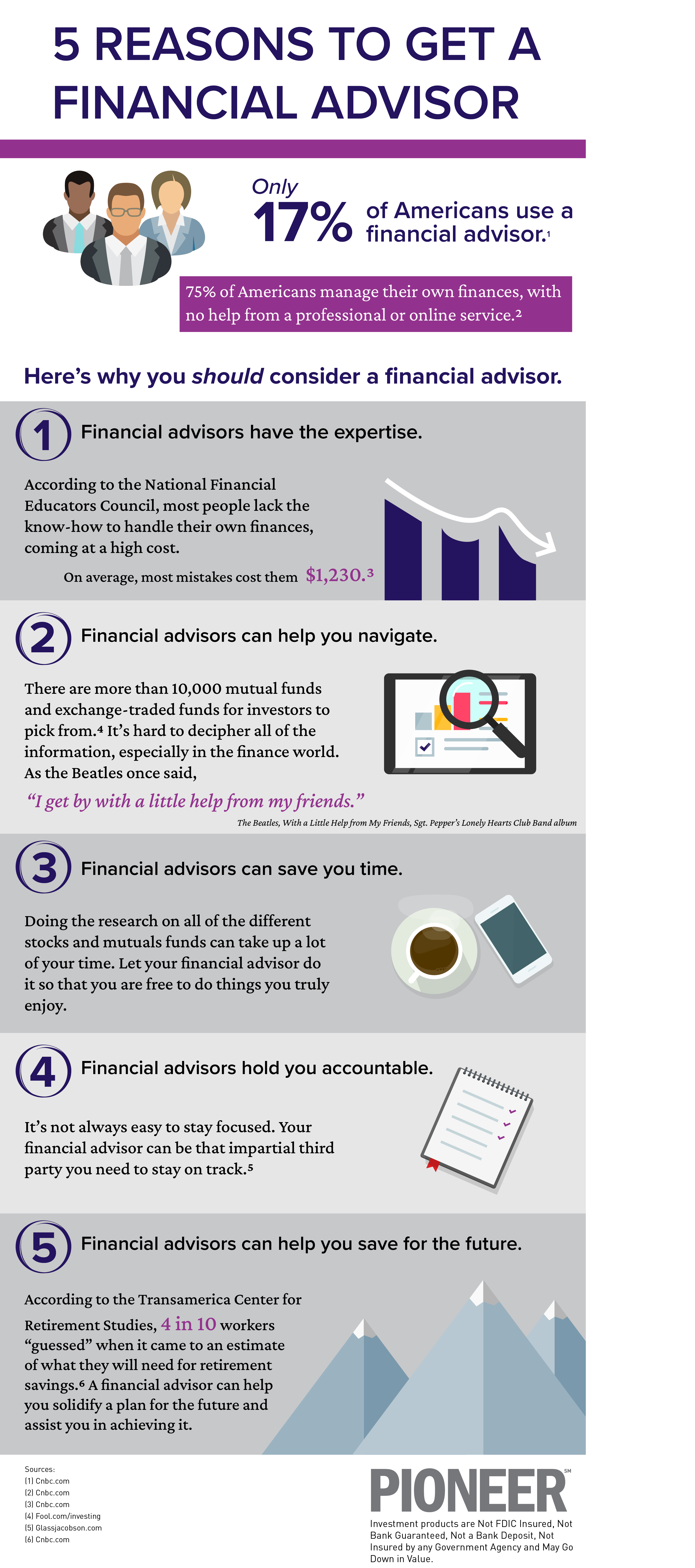

Hear this article When you hear the definition of monetary specialist, just what pops into their heads? Lots of people think about a specialized who can provide them with economic guidance, specially when considering spending. That’s outstanding place to begin, although it doesn’t decorate the entire image. Not really close! Financial analysts can really help people who have a lot of various other cash targets as well.

An economic consultant will allow you to build wide range and shield it the continuous. They're able to estimate your own future economic requirements and strategy techniques to stretch your your retirement savings. They could in addition help you on when to begin tapping into personal safety and using the money inside your retirement accounts so you can avoid any terrible penalties.

More About Lighthouse Wealth Management

They can support decide exactly what shared resources are best for your needs and show you ideas on how to manage and make more of the investments. They may be able also help you see the dangers and exactly what you’ll should do to experience your targets. An experienced investment professional can also help you stick to the roller coaster of investingeven if your opportunities just take a dive.

They are able to supply you with the advice you should develop an agenda so you can be sure that wishes are performed. And you also can’t place an Find Out More amount label regarding the comfort that accompany that. Per a recent study, the common 65-year-old pair in 2022 needs about $315,000 saved to cover healthcare expenses in retirement.

Some Known Questions About Private Wealth Management Canada.

Now that we’ve gone over just what financial advisors perform, let’s dig to the kinds of. Here’s a good rule of thumb: All financial planners are economic experts, however all experts are planners - https://www.blogtalkradio.com/lighthousewm. An economic coordinator focuses primarily on assisting folks create intends to achieve lasting goalsthings like starting a college fund or preserving for a down repayment on a house

So how do you know which economic consultant suits you - https://visual.ly/users/carlosprycev8x5j2/portfolio? Listed below are some things you can do to ensure you are really hiring the proper individual. What now ? when you've got two bad options to pick? Effortless! Find more solutions. The greater number of solutions you have, the more likely you happen to be to manufacture a beneficial decision

Lighthouse Wealth Management Fundamentals Explained

Our very own Smart, Vestor program causes it to be possible for you by showing you doing five monetary experts who can serve you. The best part is actually, it’s completely free to obtain related to an advisor! And don’t forget to come to the meeting prepared with a list of questions to ask to decide if they’re a great fit.

But pay attention, even though an advisor is actually smarter compared to ordinary bear does not give them the right to tell you what you should do. Often, analysts are full of themselves since they convey more degrees than a thermometer. If an advisor starts talking-down for you, it’s time to show them the door.

Remember that! It’s essential plus financial advisor (whoever it eventually ends up getting) are on exactly the same page. You prefer an expert who's got a long-term investing strategysomeone who’ll motivate that keep spending regularly whether or not the market is up or down. private wealth management canada. You don’t desire to work with a person who pushes one spend money on something which’s also high-risk or you are not comfortable with

All About Private Wealth Management Canada

That combine will give you the diversification you'll want to successfully spend for your long term. Whenever study economic advisors, you’ll most likely encounter the expression fiduciary obligation. This all indicates is actually any consultant you hire has got to act in a way that benefits their unique client rather than their particular self-interest.

Report this page